Download a copy of the plan (pdf)

Background

Norwich is an innovative, creative city with big ambitions for both the place and the

people who live here. The fastest growing economy in the east of England and the

regional cultural capital, it is home to the headquarters of 50 major companies as

well as being one of the UKs top shopping destinations.

Norwich has been a success story for almost 1,000 years. It is a modern city with a

historic heart. It is vibrant and growing fast. Its economic, social, cultural and

environmental influence is out of proportion to its size, and extends far beyond its

boundary. Norwich’s importance to the people of Norfolk and the wider region is

clear.

Yet in sharp contrast to this outward economic prosperity, Norwich has a low-wage

economy and high levels of deprivation. While the city has many positive aspects, it

also has some of the negative issues that urban city centres can experience – poor

educational attainment, poor health, above average crime and antisocial behaviour,

although this is reducing.

The city council is responsible for approximately 60 per cent of the urban area of the

city, including the historic city centre, covering a population of about 137,400 people.

Key data for the city is summarised in the ‘State of Norwich’ report.

The council faces severe financial difficulties over the next four years as reflected in

its medium term financial strategy. This results from government reductions in the

council’s revenue support grant and increasing cost pressures.

The council’s housing revenue account is equally challenged as a result of the

effects of the enforced 1 per cent annual rent reduction for four years considerably

reducing the rental income available to spend on housing repairs and improvements

in the future.

In addition, there are a range of uncertainties which are likely to affect the council’s

budgets in the years to come. These include the results of the government’s

consultation on new homes bonus, the determination on how it proposes councils

with retained housing stock will cover the cost of ‘Right to Buy’ of registered housing

providers, and the impact of business rates appeals and the retention of business

rates generally.

The council’s efficiency journey in recent years

Norwich City Council has been on a journey of continuous improvement in recent

years delivering significant efficiency savings and winning numerous awards along

the way. Measures have included lean systems reviews, smart procurement,

reconfiguring services and a new website to make online services easier to access.

In addition to this, initiatives have been pursued which have increased council

income – for example building a new car park.

Through these measures the council has delivered approximately £27m of recurring

revenue savings over the last six years. It won the gold award for ‘Council of the

Year’ in the Improvement and Efficiency Awards 2014 and the ‘Most Improved

Council Award’ in the Local Government Chronicle (LGC) awards 2014.

It was also a finalist in the Municipal Journal’s ‘Best Achieving Council’ award 2015

and in the LGC ‘Council of the Year’ award 2016.

However, the council has reached the point where the potential for reconfiguration of

services is increasingly limited and a redesign of the council is necessary. With the

resources available to the council in future, it will not be able to meet the aspirations

of the corporate plan and new priorities need to be set that can be delivered within

the reduced resources available.

The council’s vision, priorities and core values

The council’s current Corporate Plan sets out its vision, mission and priorities. It also describes the actions to be taken to meet those priorities alongside how success in achieving priorities will be measured. Its vision, mission and priorities are summarised below.

On 23 February 2016, the leader of the council announced that a review of the

corporate plan would be done to consider the need to reflect any changes in national

financing arrangements to both general and housing revenue funds. This was

followed by agreement from cabinet on 8 June 2016 to the initiation of a process to:

a) Work with partners in the public, private, voluntary and community sectors to

develop a new city vision.

b) Develop a revised corporate plan, priorities and performance measures which

reflects the council’s part in supporting that vision.

c) Determine a new blueprint or operating model to guide how the council works

in future which reflects available resources.

The medium term financial strategy and transformation programme

The council’s medium term financial strategy (MTFS) reflects the latest projections of

anticipated income and spend and sets savings targets to be achieved by the council

for the next five years.

The MTFS is published annually with the budget papers with the latest published

MTFS up to 2021-22 approved by council on 23 February 2016.

The document sets a net savings requirement for the council of £2.3m each year for

the next four years, reducing to £1.1m in 2021-22.

The council’s transformation programme considers the required net savings to

deliver a balanced budget for the council and brings together increasing cost

pressures, increases in income generation and planned savings to produce a set of

proposals to meet the budget challenge.

The transformation programme for 2016-17 was approved by council on 23 February

2016 as part of the budget papers. The transformation programme for 2017-18 to

2021-22 is summarised at appendix 1.

Significant uncertainty remains around a number of funding streams. In particular,

we are still awaiting outcomes following the consultation on the future of the New

Homes Bonus grant.

And the move to the retention of 100 per cent of business rates by local government

by 2020 will bring changes to that stream of funding.

Currently the council collects nearly £80m in business rates each year but only

keeps around £5m of this for its own use. While growth in business rates has been

seen it has been eroded by appeals, moves to the central list and from properties

changing use that has meant the council has not achieved its baseline funding levels

from business rates in 2015-16 or 2014-15.

The transformation programme is therefore, by necessity, a flexible programme

which needs to adjust to funding challenges as they arise.

The key themes from the transformation programme are set out below:

- Maximising income generation where possible while taking into account the

ability to pay. - Maximising returns from assets, particularly the council’s commercial portfolio

and investing for further return. - Review of the customer contact model and service standards including

moving to more digital engagement following the recent launch of the

council’s new website. - Review of neighbourhoods and enforcement functions including achieving efficiencies through more streamlined enforcement functions and encouraging active participation in neighbourhoods by residents.

- Working with partners to maximise income and reduce costs including through shared services.

- Organisational review and work styles, which has started with the recent review of the senior management structure.

- Review of support services and overheads to minimise support costs and protect frontline services wherever possible.

- Reductions in service levels and/or stopping services including a review of the balance between spend on statutory and discretionary services and the priorities in the Corporate Plan.

Use of reserves

The council had general reserves of £12.1m at 1 April 2016. It has adopted a policy

of using reserves to smooth the savings required across a number of years to enable

a more planned approach to the delivery of savings through the transformation

programme.

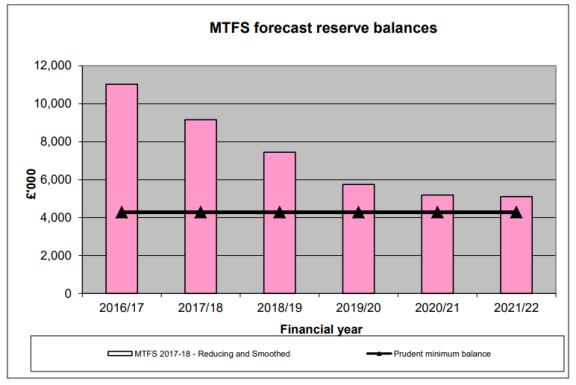

In line with this policy, the MTFS assumes that reserves will reduce significantly over

the next five years to just over £5m. The council sets a prudent minimum level of

reserves as part of budget setting each year which is designed to be sufficient to

meet unforeseen circumstances that may arise.

This prudent minimum level of reserves currently stands at £4.3m. The MTFS

forecast reduction in reserves and the anticipated level of reserves compared to the

prudent minimum level are shown in appendix 2.

Government funding and the four year offer

On 10 March 2016 the Secretary of State for Communities and Local Government

wrote to all council leaders offering a four year settlement subject to publication of an

efficiency plan. The funding streams included within this settlement offer are revenue

support grant (RSG), rural services delivery grant and transitional grant.

The council does not receive either of the latter two grants but revenue support grant

amounts as per the indicative four year allocations are set out below:

| Year | 2016-17 | 2017-18 | 2018-19 | 2019-20 |

|---|---|---|---|---|

| Indicative RSG funding | £2,567k | £1,671k | £982k | £213k |

No revenue support grant is expected beyond 2019-20.

These reductions in government funding will be very challenging to address given

the level of savings already delivered in recent years. But the council welcomes the

certainty of funding offered which will enable the transformation programme to

progress in a more planned way over the next four years without having to respond

to annual changes in government formula funding.

Wherever possible the council is seeking to generate new streams of income to

avoid cuts to services. Recent examples of this include a new car park and the

establishment of a housing development company to provide high quality homes

within the city while at the same time providing an income stream for the council.

The council is also looking at a range of other income options and its current income

streams to ensure income generation opportunities are maximised.

The council’s Corporate Plan sets the following targets for income from fees and

charges as a percentage of spend:

2015-16: 43.2%

2016-17: 44.2%

2017-18: 45.2%

For 2015-16 the council exceeded its target with income from fees and charges

representing 47.6 per cent of spend. These income targets exclude income from

council tax and business rates and funding from grants.

Total projected income, excluding funding from grants, is forecast to total £41.1m by

2020 as set out below.

| Source of funding (2020) |

Anticipated funding level £k |

|---|---|

| Business rates | 5,610 |

| Council tax | 8,765 |

| Fees and charges | 26,791 |

| Total | 41,166 |

The housing revenue account (HRA)

While the MTFS covers the general fund budget, the HRA has a separate business

plan which covers both its revenue and capital spend over a 30 year period.

The latest business plan was approved by council on 23 February 2016. Following

the 1 per cent annual rent reduction for social rents for four years from 2016, set out

in the Welfare Reform and Work Act 2016, and the anticipated determination

required to be paid in future introduced in the Housing and Planning Act 2016 to fund

right to buy sales by registered providers, the HRA is like the general fund under

significant financial pressure.

Some £7m per year has been removed from the HRA business plan already as a

result of the 1 per cent rent reduction, mainly through reduced costs of maintenance.

Further efficiencies in spend are being sought in HRA services to prepare for the payment of the determination. The transformation programme themes therefore covers both general fund and HRA funded services.

Use of capital receipts

In the spending review 2015 the chancellor of the exchequer announced that to

support local authorities to deliver more efficient and sustainable services, the

government will allow local authorities to spend up to 100 per cent of their fixed asset

receipts (excluding Right to Buy Receipts) on the revenue costs of reform projects.

The council has a range of assets which it holds – the most significant of which are

its housing stock and investment properties. The housing stock sits within the

housing revenue account (HRA) which is a ring fenced account and capital receipts

from this could only be used for efficiency projects within housing.

The stock of investment properties requires ongoing maintenance and investment to

maintain income streams and these costs are already funded from capital receipts.

Spend on essential works to other assets is also funded from capital receipts and

with a desire to keep assets within the portfolio which have good revenue returns the

availability of further capital receipts to fund the revenue costs of reform is limited.

For 2016-17 the council is anticipating £1.6m in funding from capital receipts but

these are fully committed to the capital programme. The council is not therefore

planning to fund any costs of reform from capital receipts.

Working with partners

The council recognises that to achieve the best for Norwich with decreasing

resources it needs to work collaboratively with public, private and voluntary sector

organisations.

In particular, the council has partnered with its neighbours Broadland District

Council, South Norfolk Council and Norfolk County Council to form the Greater

Norwich Growth Board producing a Joint Core Strategy for the Greater Norwich

area.

The council has set up joint ventures with the Norse group for the provision of

property and environmental services, managing its commercial portfolio and

maintaining and enhancing its housing stock.

It has partnered with LGSS via Cambridgeshire County Council and

Northamptonshire County Council for the provision of services including finance and

IT.

In addition, it has also partnered with other local councils across Norfolk and East

Anglia for legal services and building control and works with the county council, local

health and police services.

Of course, it is not just the city council that is facing diminishing resources, the

county council, probation service, police, clinical commissioning groups and NHS

trusts are all under pressure.

The same is also true for voluntary and community organisations, with who we

collaborate and from whom we commission services. It is unclear how these varying

pressures will impact collectively on the people of Norwich.

The approach we have taken across voluntary and statutory partners is to identify

areas of common concern and where we can have a positive impact on shared

priorities, while recognising each organisation has its own sets of priorities.

The council’s operating model, focussing particularly on the delivery of front line

services, needs to continue to evolve with greater transformational change. Using

and integrating the principles of the council’s neighbourhood working model –

reducing duplication, greater collaboration with partners, developing the role of

residents, demand management and behaviour change – a number of approaches

are being developed.

These have often been tested and piloted to understand their effectiveness and how

they will contribute to the council’s financial sustainability. The following are some

examples of where the council work in partnership to deliver services.

Early help

Working with Norfolk Children’s Services, Norfolk Constabulary and Norwich CCG to

deliver an Early Help Hub that provides partners with a space to collaborate, consult

with one another, problem solve and share information to make sure families and

residents in need of help, receive the most appropriate and effective support as soon

as possible. The objective is to provide help where it is required early to reduce

delay and duplication and reduce the need for higher cost interventions.

Where early help fails to make a difference, issues will be escalated swiftly to the

correct service or specialist team who can provide an intervention. This might include

the joint council and police operational partnership team that focuses on risk based

ASB interventions or the council’s families unit that supports families with multiple

and complex needs enabling them to maintain their tenancies, manage their homes

and their children effectively within their communities and move towards social

inclusion.

Collaboration with the voluntary sector

With Norwich facing significant deprivation issues, the corporate priority of a fair city,

sets out to reduce the social, financial and economic inequality that occurs in some

communities.

The provision of free access to advice services is an important part of the council’s

response to these often deep and entrenched needs. Using a needs assessment to

scope the service requirements, and using the council’s commissioning framework

that sets out to secure value for money through better relationships with public, private and voluntary organisations, a consortium of voluntary organisations comprising Norfolk Community Law Service, Age UK Norwich, Shelter, Mancroft

Advice Project (MAP), and Equal Lives, are delivering a variety of debt management,

financial capability and income maximisation services specified.

Using this approach allows providers to develop the interventions based on their own

expertise and knowledge of clients rather than the council prescribing activity and

risk losing the innovation available in the sector as well as helping to deliver a

flexible, effective and sustainable advice sector in the city.

This collaboration is being developed further with an area based approach being

tested in one part of the city to reduce the issues of inequality. This project is taking

a preventative approach to improving the health and wellbeing of residents in

Lakenham, with a focus on those on low incomes and/or suffering the poorest health.

The programme is delivering coordinated action by the council, partners including

the GP surgery, Children’s Centre, CAB, schools, Norse Commercial services and

the community with the aim of trialling new ways of working to to join up local services and engage and build resilience within the local community.

Community enabling and active communities

Norwich has a long history of community led activity and there are opportunities for

the council to support and enable local residents to be more self-sufficient. This will

allow the council to focus its reducing resources on those more vulnerable residents

who really need help.

Working through an asset based approach and in partnership with existing voluntary

and community sector organisations, the council will encourage greater self-service

among citizens and residents to be more involved in the life of their neighbourhood

dealing with local challenges by the community themselves.

If successful, and residents are more active with increased skills, confidence and

aspiration, there is the potential to develop the social value of the council’s

procurement by stimulating social and community enterprises to deliver certain

council contracts that provide local employment and value for money service

delivery.

Appendix 1: transformation programme indicative income increases, savings

and cost pressures 2017-18 to 2020-21

| 2017-18 | 2018-19 | 2019-20 | 2020-21 | |

|---|---|---|---|---|

| Income generation | £961k | £848k | £471k | £577k |

| Maximising returns from assets | £75k | £192k | £369k | £150k |

| Customer contact model and service standards | £315k | £315k | £315k | £315k |

| Neighbourhood and enforcement | £200k | £440k | £226k | £200k |

| Working with partners and shared services | £670k | £205k | £205k | £532k |

| Organisational review and work styles | £98k | £48k | £85k | £50k |

| Review of support services and overheads | £343k | £132k | £107k | £193k |

| Reductions in service levels and / or stopping of services including a review of the balance between spend on statutory and discretionary services, and the priorities in the corporate plan | £297k | £885k | £1,287k | £1,048k |

| Less: Cost pressures | £(644)k | £(750)k | £(750)k | £(750)k |

| TOTAL | £2,315K | £2,315K | £2,315K | £2,315K |

We will do our best to focus on income generation, efficiencies through remodelling of services, and reducing cost pressures where possible. But inevitably we will have to consider reductions in service levels and stopping services to meet the level of savings required. Detailed savings proposals will continue to be presented to the council for agreement on an annual basis.

Appendix 2: MTFS forecast general reserve balances 2016-17 to 2020-21